– Bret Nason, Lancaster, Wisconsin bankruptcy attorney

More bankruptcy questions? Check our our FAQ page.

This page contains general information. Contact a WBG attorney for specific advice.

This page contains general information. Contact a WBG attorney for specific advice.

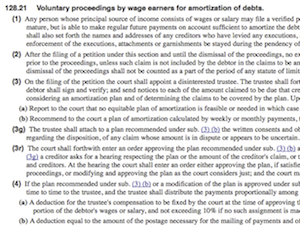

Chapter 128.21 of the Wisconsin Statutes allows debtors to pay debts in full over 36 months at 0% interest. A typical Chapter 128 filer has a small amount of credit card debt and could afford to make the payments if not for the outrageous interest rates. It is not a bankruptcy and cannot be reported to the Credit Reporting Agencies as a bankruptcy.

Here is a brief outline of the process if you choose to file a Wisconsin Chapter 128:

– Your attorney will prepare a petition and affidavit of debts.

– Because a Chapter 128 is not a bankruptcy proceeding, these documents will be filed in your local county court, not in bankruptcy court.

– A trustee, usually chosen by your attorney, will be assigned by the court.

– The trustee will put together a payment schedule that will pay all of the debts you included in your affidavit at 0% interest.

– The trustee will be paid a commission of 8% – 10% of everything that passes through his/her hands.

– The plan will last no longer than 36 months.

– At the end of your plan, the debts that you included in your plan will be paid in full.

A Chapter 128 may be preferable to a bankruptcy in some situations, even though it will typically cost more in the long run. (Repaying just $5000 through a Chapter 128 over three years is likely going to cost more than the attorney fees in a Chapter 7 bankruptcy.) For example, a Chapter 128 does not require any court hearings or meetings, while a bankruptcy case will require at least one appearance at your 341 meeting. Other advantages of Chapter 128 include:

- If you have nonexempt assets, they are not at risk in a Chapter 128,

- Unlike bankruptcy, you are allowed to pick and choose which debts to include in a Chapter 128, and

- Debts are repaid instead of discharged.

If these differences are worth the extra cost to you, a Chapter 128 is worth considering. But you should speak with an attorney to learn about all your options before making your decision.

Both bankruptcy and Chapter 128 can stop garnishments. However, only bankruptcy prevents creditors from suing you. Technically, a creditor can sue and get a judgment while you’re in a Chapter 128, but it cannot collect on that judgment through garnishment. The Chapter 128 filer is essentially collection-proof during the repayment period. Reasonable creditors understand that there is no benefit to suing while you are in a Chapter 128 and will hold off as long as they are getting paid.

If you’re interested in using a Chapter 128 to get out of debt, speak with a WBG attorney today.

More bankruptcy questions? Check our our FAQ page.

This page contains general information. Contact a WBG attorney for specific advice.

Wisconsin Bankruptcy Guide is provided by law firms designated as Debt Relief Agencies by the federal government because we help people file for relief under the Bankruptcy Code. We also provide other types of debt relief options.