– Bret Nason, Lancaster, Wisconsin bankruptcy attorney

More bankruptcy questions? Check our our FAQ page.

This page contains general information. Contact a WBG attorney for specific advice.

This page contains general information. Contact a WBG attorney for specific advice.

When you file a Chapter 7 bankruptcy in Wisconsin, you will have three options for dealing with secured debts. You can redeem the collateral, surrender the collateral, or reaffirm the debt. This article will explain Reaffirmation Agreements.

Some assets are collateral for secured debts. The most common examples are cars (collateral for the vehicle loan) and houses (collateral for the home mortgage). Your bankruptcy case will (hopefully) result in a discharge of your debts. But if you don’t pay on your secured debts, those creditors can take their collateral, either by repossession or foreclosure. What if you want to keep those assets? That’s where reaffirmation comes in.

When you reaffirm a debt, you’re telling the secured creditor that you want to continue making your payments and keep the collateral, as if you never filed bankruptcy at all. While creditors are not required to allow you to reaffirm the debt, very few will refuse. After all, they want your money, not your house or car. If you’re willing to pay, they’re willing to accept your payments.

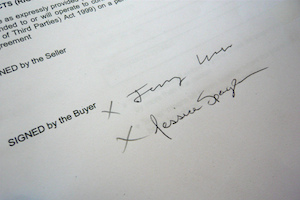

Your attorney will ask what you’d like to do with all of your secured debts. For those that you choose to reaffirm, the lender will send your attorney a Reaffirmation Agreement. This agreement says that you will continue making your payments as always and that the debt will not be discharged in your bankruptcy. Think of it as saying, “we’re going to pretend like I never filed bankruptcy with respect to this debt only.” Once the reaffirmation agreement has been signed by you, your attorney, and the creditor, it will be filed with the bankruptcy court.

Should you sign a reaffirmation agreement? It depends on the specifics of your situation; here are some things to consider:

– What is the value of the collateral?

– How much debt are you reaffirming?

– Do you owe more than the collateral is worth?

– How important is for you to keep this specific house or car? They make cars and houses every day.

– Do you intend to refinance the loan in the future?

– Does your state allow deficiency judgments in the case of default?

– Does your state allow a creditor to repossess a vehicle if you remain current on your payments but don’t reaffirm the debt?

– Are you willing to give up the benefit of your bankruptcy discharge with respect to this debt?

– Is credit reporting important to you?

There are also other issues to think about. Be sure to ask your bankruptcy attorney for an opinion on reaffirmation agreements when you file your case. While your attorney can help guide you, this important decision is yours.

More bankruptcy questions? Check our our FAQ page.

This page contains general information. Contact a WBG attorney for specific advice.

Wisconsin Bankruptcy Guide is provided by law firms designated as Debt Relief Agencies by the federal government because we help people file for relief under the Bankruptcy Code. We also provide other types of debt relief options.

Image Credit: flickr/WordRidden